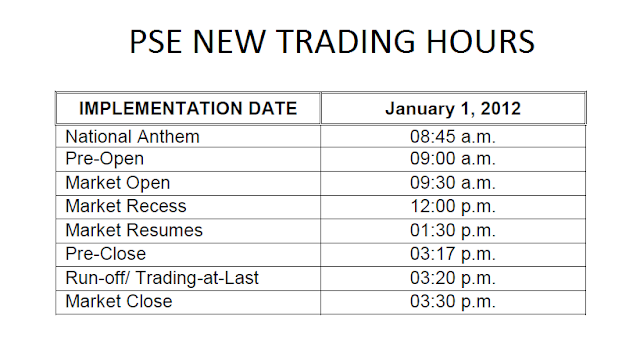

As of 03 October 2011 PSE trading hours has been extended for an hour to 01:00 pm. It was an implementation of Phase 1 of a 2 series trading hour extension . Trading opens at 09:00 am and closes at 01:00 pm. This will again be changed as an implementation of Phase 2 wherein trading will still open at 09:00 am but will then close at 03:30 pm. Below is the new trading schedule which will take effect on 02 January 2012 taken from a PSE memorandum:

...encouraging Filipinos especially OFWs to get financially educated and be smarter with their money.

Friday, December 23, 2011

Wednesday, November 2, 2011

Thinking of Opening a Franchise?

Thinking of starting a business? I've been lately, but I have no experience in running one. Then I realized there might be no better way to start than to become a franchisee. I read somewhere that the percentage of success in opening a franchise than starting from scratch is much higher since you will already be handed the successful business model of the franchiser. The franchiser will be there to help and guide you along the way. It's like using the experiences of the successful entrepreneur who started the business so you won't need to go through the hardships, and trial and errors new business owners have to deal with. Along with it are restrictions enforced by the fanchiser so as a franchisee you won't be able to really do the things that you want in running the business. Many still consider it though as a good start to entrepreneuship.

I know a lot of people are interested to venture into this sort of business set-up so I've checked some common franchises that Im interested in to get an idea about the requirements and most importantly the cost. I listed them below. The company names are linked to the Frequently Asked Questions (FAQ) section of their website where you'll find interesting and helpful information.

Franchinsing alone however, according to seasoned entrepreneurs doesn't guarantee success. Knowledge, skills and hard work are still the key. Also, if you are an OFW like me, opening a franchise store or starting any business for that matter without you personally looking after things might not be a good idea. If you are serious and really want to succeed, you better pack your bags and leave for good. This I hope I can do very soon. ^_^

How about you, do you have any franchising opportunity in mind or any franchising experiences you want to share? Please feel free to put them on the comments section below.

|

| Business 3D |

I know a lot of people are interested to venture into this sort of business set-up so I've checked some common franchises that Im interested in to get an idea about the requirements and most importantly the cost. I listed them below. The company names are linked to the Frequently Asked Questions (FAQ) section of their website where you'll find interesting and helpful information.

Convenient store

Drugstores

Gasoline stations

LPG stores

Franchinsing alone however, according to seasoned entrepreneurs doesn't guarantee success. Knowledge, skills and hard work are still the key. Also, if you are an OFW like me, opening a franchise store or starting any business for that matter without you personally looking after things might not be a good idea. If you are serious and really want to succeed, you better pack your bags and leave for good. This I hope I can do very soon. ^_^

How about you, do you have any franchising opportunity in mind or any franchising experiences you want to share? Please feel free to put them on the comments section below.

Labels:

7-eleven,

Business,

Caltex,

convenient store,

drugstore,

Gamont publiko,

Gasoline station,

Gasul,

Generics Pharmacay,

Generika,

LPG,

Open franchise,

Petron,

Phoenix,

PR gas,

Seaoil,

Shell

Sunday, August 7, 2011

How You Can Lose Money in the Stock Market

|

Investing in the stock market may be very rewarding financially but if you're not cautious it may cost you your life savings too. It is a high yield high risk type of investment. This means that the return on your investment can be very high but the risk of you losing your money is also high. It is very important for anyone who intends to invest in the stock market to understand this.

Here are common ways to lose money in the stock market.

1. Company gets bankrupt.

If the company you are invested in gets bankrupt and has to shutdown, the value of your stock plummets. The share price of the stock would head down to zero, though not necessarily instantly. You could lose most of your investment if not all of it.

This is why it is advisable for an investor especially the newbie and those who cannot monitor the market regularly to select stocks of big and stable companies.

2. Stock is sold at a lower or at the same buying price.

The stock market is a very volatile environment. Stock share prices go up and down all the time due to constant buying and selling. But who wants to sell their stock at a loss? Definitely no one. Unfortunately there are lots of instances where an investor must do so.

When an investor runs out of money or needs money immediately due to a financial emergency he has no choice but to sell his stock even when the price per share is low. When a company is not earning, not growing or not performing as expected, there will be more selling than buying of its stock resulting to drop in its share price. Unless an investor has a long term horizon, has strong belief and conviction that company the will recover and perform very well in the future, the investor sells the stock to stop further losses. Bad economy affects the prices of stocks too, may it be local, regional or global. Disturbing news surely makes people worry or panic results to a plunge in stock prices. Investors again try to cut losses, by dumping their stocks.

If shares of a stock are sold at the same buying price, investors also lose from transaction fees such as broker commission, value added tax, PSE transaction fee and SCCP fee. An additional sales tax is charged when selling.

3. Stock is not appreciating.

When the stock’s value is not appreciating, your money is not growing. It will be losing its value due to inflation. Prices of commodities are rising so what your money can buy now may not be enough to buy the same items in the future. However, if you see a promising future for the company and are willing to wait then things could work out for you. Also if cash dividends are paid out often, then keeping the stock might still be a good move.

There’s no doubt that investing in the stock market is very risky. Stories of people who were traumatized from losing their money are heard often. Many even swear never to touch stocks again. However if you are well informed, are in for the long haul and believe that you can ride the ups and downs of the market then there’s nothing to worry about, this type of investment instrument is perfect for you. Besides, despite all the market crashes and recessions, history shows that investing in stocks is still the best and easiest way to accumulate wealth and secure ones financial future. Who doesn’t know Warren Buffet? ^_^

Thursday, August 4, 2011

How to Grow Your Thousands to Millions Without Doing Anything

Do you know how much your Php10, 000 would be worth now if 10 years ago you’ve decided to invest this small amount in the Philippine stock market? If you’re that smart one, it might now be worth millions!

Below is a list of some blue chip stocks listed in the Philippine stock exchange with their corresponding price per share taken on the 1st week of January for both 2001 and 2011. In this 10 year period, big changes in the stock share prices are apparent.

PX is the best performer with a whopping 11619% gain. Its share price multiplied more than 117 times! If you bought Php10, 000 worth of PX shares on January 2001 and forgot about it for 10 years, it would now be worth more than Php1, 170,000! What’s cooler than that? If your investment were Php100, 000, you have just earned more than Php11, 170,000! You’re a now a multi-millionaire!

As of August 03, 2011, PX share price is at 22.55. So if you’ve waited for another few months, you’re Php10, 000 is now worth more than 1.67 million pesos!

The other 3 stocks performed well too. JFC share price lifted more than 9 times, ALI increased almost 4 times and BPI more than doubled.

Php100, 000 bought on BPI shares would be worth more than Php200, 000. It is the least performer in the list yet without a doubt it has outperformed any savings and time deposit account offered by any bank in the country. That's cash and stock dividends not yet included. I’m sure the cash dividend is significant considering that BPI regularly pays out cash dividends.

The 4 stocks above are not the only blue chip stocks listed in the Philippine stock exchange, there a lot of others to choose from. I think the share price of most if not all of them has appreciated significantly. However, it is important to note that past performance is not a guarantee of future performance. There are risks in investing in the stock market as with other form of investments. Knowledge is the best defense against risk. For newbie investors like me, investing for the long term say more than 5 years in big and stable companies is wise.

I’ve been investing in the Philippine stock market for a few months now and my investment has appreciated almost 20% and still growing! I’m very happy about it. Who knows what would happen to my investment in the next 10 years. However, with things starting to change in our country, I’m very hopeful. ^_^

To learn how to start investing in the Philippine stock market, click here.

Labels:

ALI,

Ayala land,

Bank of the philippine islands,

BPI trade,

invest,

investing,

JFC,

Jollibee,

millionaire,

millions,

Philex Mining,

Philippines,

PX,

rich,

stocks,

thousands

Wednesday, July 20, 2011

List of Philippine Online Stock Brokers

|

| Young Man With Laptop in the Park |

AB CAPITAL SECURITIES, INC.

Filomeno G. Francisco

8/F Phinma Plaza, 39 Plaza Drive

Rockwell Center, Makati City

Office: 898-7555

Exchange: 891-9135

Fax: 810-3739; 810-7015

Email:abcsi@abcapital.com.ph

Website: www.abcapitalonline.com

Filomeno G. Francisco

8/F Phinma Plaza, 39 Plaza Drive

Rockwell Center, Makati City

Office: 898-7555

Exchange: 891-9135

Fax: 810-3739; 810-7015

Email:abcsi@abcapital.com.ph

Website: www.abcapitalonline.com

ACCORD CAPITAL EQUITIES CORPORATION

G/F, Unit EC-05 B, PSE Center East Tower

Exchange Road, Ortigas Center, Pasig City

Office: 687-3224;687-3733; 687-3740; 687-5071 to 74

Exchange: 687-0911; 687-0936; 634-1467

Fax: 687-3738

G/F, Unit EC-05 B, PSE Center East Tower

Exchange Road, Ortigas Center, Pasig City

Office: 687-3224;687-3733; 687-3740; 687-5071 to 74

Exchange: 687-0911; 687-0936; 634-1467

Fax: 687-3738

Website: www.philstocks.ph

BPI SECURITIES CORPORATION

8/F BPI Head Office Ayala Avenue

Cor. Paseo de Roxas, Makati City

Office: Marketing 816-9190;816-9192 to 93

BPI Trade 816-9678; 845-5427

Exchange:891-9930; 891-9260; 845-5541;

845-5543;845-5545

Fax: 816-9191

Website: www.bpitrade.com

CITISECURITIES, INC.

Edward K. Lee

27/F East Tower-PSE Center, Exchange Road,

Ortigas Center, Pasig City

Office: 635-5735 to 40

Exchange: 634-6976 to 80

Fax: 634-6696

Edward K. Lee

27/F East Tower-PSE Center, Exchange Road,

Ortigas Center, Pasig City

Office: 635-5735 to 40

Exchange: 634-6976 to 80

Fax: 634-6696

Website: www.citiseconline.com

FIRST METRO SECURITIES BROKERAGE CORPORATION

18/F PSBank Center, 777 Paseo de Roxas cor. Sedeño St.

Makati City 1226

Phone: (+632) 8590600

Fax: (+632) 8590699

Email address: customerservice@firstmetrosec.com.ph

18/F PSBank Center, 777 Paseo de Roxas cor. Sedeño St.

Makati City 1226

Phone: (+632) 8590600

Fax: (+632) 8590699

Email address: customerservice@firstmetrosec.com.ph

Website: http://www.firstmetrosec.com.ph/

F. YAP SECURITIES, INC.

Felipe U. Yap

23/F East Tower-PSE Center, Exchange Road,

Ortigas Center, Pasig City

Office: 635-4125 to 30; 635-4141

Exchange: 634-5171;634-6917;634-5390 to 91;634-6217 to 18

Fax: 635-2911

Felipe U. Yap

23/F East Tower-PSE Center, Exchange Road,

Ortigas Center, Pasig City

Office: 635-4125 to 30; 635-4141

Exchange: 634-5171;634-6917;634-5390 to 91;634-6217 to 18

Fax: 635-2911

Website: www.2tradeasia.com

RCBC SECURITIES, INC.

Alicia Rita M. Arroyo

7/F Yuchengco Tower, RCBC Plaza,

6819 Ayala Ave., Makati City

Sales: 894-9438 to 39;

845-2634; 845-2615/25/37/40;894-9443

Research 894-9445;

Operations/Settlement 894-9441

Exchange: 848-5183

Fax: Sales 845-2609; Operations 894-9440

Email: sales@rcbcsec.com

Website: www.rcbcsec.com

Alicia Rita M. Arroyo

7/F Yuchengco Tower, RCBC Plaza,

6819 Ayala Ave., Makati City

Sales: 894-9438 to 39;

845-2634; 845-2615/25/37/40;894-9443

Research 894-9445;

Operations/Settlement 894-9441

Exchange: 848-5183

Fax: Sales 845-2609; Operations 894-9440

Email: sales@rcbcsec.com

Website: www.rcbcsec.com

WEALTH SECURITIES INC.

2103 East Tower Philippine Stock Exchange Centre

Exchange Road, Ortigas Center, Pasig City

Exchange Road, Ortigas Center, Pasig City

Tel. Nos.: 689-8000 / 634-5038

Fax. No : 634-5043

Email To : office@wealthsec.com / sales@wealthsec.com

URL : http://www.wealthsec.com

Fax. No : 634-5043

Email To : office@wealthsec.com / sales@wealthsec.com

URL : http://www.wealthsec.com

How to Start Online Buying and Selling of Stocks in the Philippine Stock Market

Many Filipinos have no idea how to invest or trade in the Philippine stock market. A lot are interested but they simply do not know where to start. Many think the process is complicated, but it’s not. It could be in the past when internet wasn’t born yet, but now with the appearance of online stock brokerage firms, it has become as simple as opening a bank account. Anyone, can do it whenever and where ever there's internet access. Stay at home moms can buy stocks at the comfort of their homes and OFWs can participate wherever they are in world. You can invest long term in your favourite stock and watch your money grow. How cool is that? Also, now buying and selling stocks is not only accessible to the rich because it doesn’t require that much money as before. The truth is, anyone with as small as Php5,000 can become a shareholder or stockholder of a company listed in the Philippine Stock Exchange (PSE). All you have to do is follow these 3 simple steps.

|

| Chart Made By Coins by worradmu |

1. Find and select a Philippine online stock broker.

There are several online stock brokerage firms in the country and you can search them through Google. The familiar ones are CitisecOnline Stock Brokers (www.citiseconline.com), First Metro Securities Brokerage Corp.(www.firstmetrosec.com.ph) and BPI Securities Corporation (www.bpitrade.com). For the complete list click here.

Check their websites and from there you’ll get an idea basically everything you need to know about the firm, their service, their charges and how their online platform works and looks like. You can also call or email them for any additional information you need.

I use CitisecOnline and so far I’m satisfied with it. Firstmetrosec I’ve heard is very reliable too.

2. Open an online stock broker account.

Once you have decided which online stock broker to use, you’re now ready to open an account. The application process is generally the same for most of them. You simply have to fill up the forms available in their website, print and fill out, and together with other requirements such as copies of valid Ids and bank statements, send all the documents through courier to the broker’s office address. When your application is approved, they will send you a confirmation e-mail which would also contain your account number, username and password.

For the detailed steps, specific requirements and additional information, visit the website of the online stock broker of your choice by clicking on its link above and follow their online account application process.

3. Fund the account.

The last step is to fund your new account. Your account must have funds to enable you to start buying stocks. You can do this by either depositing the fund over-the –counter in you bank or transfer it online through your bank’s internet banking service. Every broker has a minimum amount requirement though in opening an account so make sure you are aware of this. For CitisecOnline, their EIP account or starter account requires a minimum of Php5,000 deposit and Php25,000 for regular trading accounts.

For those who have no time to personally go to the bank and make deposit, it’s best to learn and start using your bank’s online internet banking service. It would be a lot more convenient.

After your initial fund have been received and/or cleared which can take around 1 to 3 days depending on your bank’s clearing time, you can already start buying stocks.

It’s that simple. Good luck in buying your first stock! ^_ ^

Labels:

bpitrade,

citiseconline,

firstmetrosec,

invest,

money,

moneysmart pinoy,

OFW,

online,

Philippine stock market,

pinoy,

trade

Subscribe to:

Posts (Atom)